Helping Impact Investors Generate Social and Environmental Impact

How We Help You Meet Your Impact Investing Goals

We bridge the worlds of finance and consulting with a deep commitment to grounding our analysis in rigorous research and quantitative evidence.

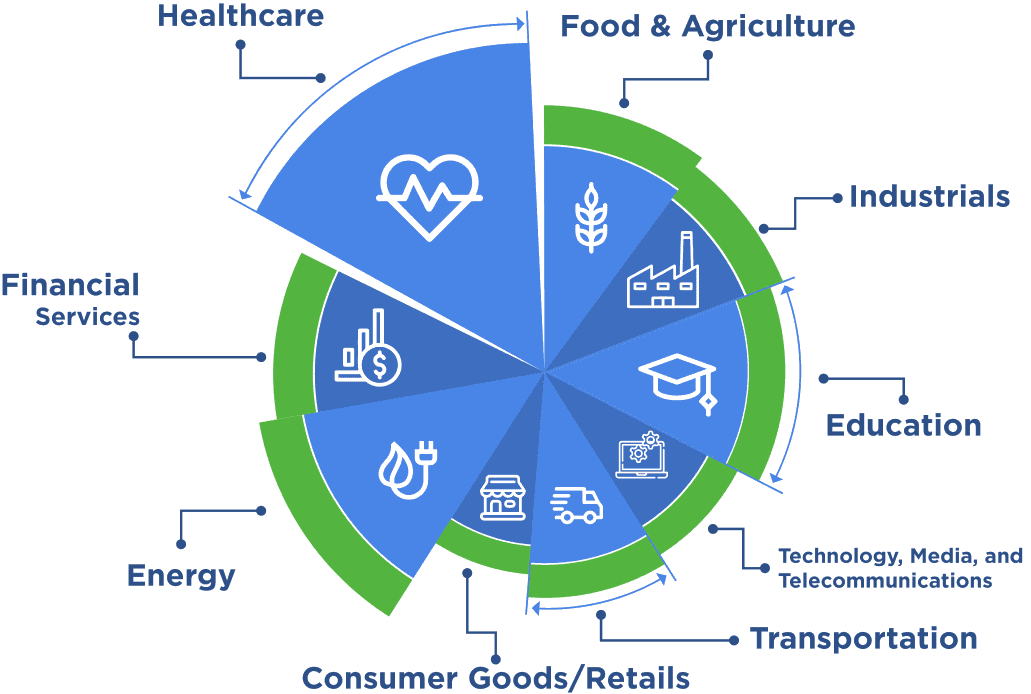

We speak the language of finance and the language of impact while taking into account structural barriers involving race, gender, and other aspects of equity specific to the regions in which you want to invest. And we have experience assessing more than 1,200 potential impact investments in nine sectors across more than 50 countries. Our services include:

Fund Strategy

We help you articulate the impact you want to achieve, identify priority outcomes, and find the right balance between financial return and impact. (For more detail, see our frequently asked questions about getting started with impact investing.)

Thesis Development

We’ll work with you to create opportunity maps, articulate your investment theses and develop logic models linking those theses to evidence.

Impact Underwriting

We can develop an impact assessment methodology to fit your needs, formalizing impact assessment as part of due diligence, and assess the impact of potential deals (aligned with the Impact Management Project).

Portfolio Support

We’ll help you develop a process to measure impact, both during ownership and at exit, and identify key performance indicators to track during holding based on the investment’s industry. (For further explanation, see our frequently asked questions about measuring impact.)

As an impact investor, you make investments with the intention to generate positive, measurable social and environmental impact alongside a financial return. Bridgespan Social Impact collaborates with asset managers and institutional investors to generate market-rate returns alongside measurable social and environmental impact. Whether you want to set and revise your fund impact strategy, develop an impact assessment methodology, or measure and manage your impact during ownership, our experienced teams can help.

How We Helped ABC Impact Develop an Impact Framework

ABC Impact, a cross-sectoral impact investing fund launched in 2019, aims to close gaps in progress toward the UN’s Sustainable Development Goals (SDGs) and galvanize the Asian investing community toward greater impact. As part of the fund’s launch, we helped the client team develop an impact approach and assessment framework that incorporated key questions on prioritization, evaluation, and monitoring of SDG-linked targets. We continue to collaborate with ABC Impact to conduct impact diligence on pipeline opportunities.

How We Collaborated with The Rise Fund

The $2 billion Rise Fund is the world’s largest impact investment fund committed to achieving outcomes aligned with the UN’s Sustainable Development Goals. We collaborated with the Rise Fund to develop a rigorous, quantitative impact assessment methodology (the Impact Multiple of Money) to evaluate potential investments. We also assisted in executing this assessment for four years, underwriting the social and environmental impact of every potential investment. Our work culminated in the creation of Y Analytics, an impact measurement spin-off of the Rise Fund.

What The Rise Fund Has to Say About Working With Bridgespan Social Impact

“Bridgespan Social Impact’s work is practical, execution-oriented, and courageous. I believe their contributions to The Rise Fund will advance the field of impact investing and our collective desire to measure and manage towards greater impact.”

Maya Chorengel, Senior Partner

The Rise Fund

Bridgespan Social Impact Publications

Our publications are prominently featured on news platforms that reach both the social sector and the the business world. The breadth and depth of topics covered by our publications position us as thought leaders in the impact investing industry. For a more complete list, please visit our impact investing publications page.

From Principle to Practice: The Case for Gender-Lens Investing

Research shows that gender-lens investing offers a proven pathway to stronger financial performance and measurable social outcomes, with women-inclusive businesses delivering higher returns, lower risk, and expanded market opportunity. For those seeking scalable sustainable impact, integrating gender equity is becoming a strategic advantage, rather than a tradeoff.

Investing in Human Rights: Six Areas for Impact and a Database of Change

By Capricorn Investment Group, Bridgespan Social Impact, Robert F. Kennedy Human Rights

When we think about human rights, we often picture activists with protest signs or diplomats at negotiation tables. But what about investors? The financial community has an increasingly powerful role to play in advancing human dignity around the world—and forward-thinking institutions are recognizing this opportunity.

Capricorn Investment Group

Capricorn’s Sustainable Investors Fund makes early-stage investments in innovative asset-management firms to help propel their work on environmental and social issues.

Frequently Asked Questions

What is the difference between an impact investment and those screened for environmental, social, and governance (ESG) issues? How do I integrate my existing ESG processes into my impact fund?

ESG and impact investing are sometimes used interchangeably. However, we believe they are two complementary but distinct approaches. ESG criteria set baseline standards to evaluate companies’ footprints for high social, environmental, or governance risk. As such, all investors can incorporate ESG considerations into their impact measurement and management practices. Impact investors go a step further into understanding the social and environmental impact of companies’ product and service portfolios, and only invest in businesses where these core offerings create positive impact.

What is impact investing and why should you care?

Solving our biggest social problems requires private capital: The United Nations estimates a need for $3.9 trillion a year between now and 2030 to meet the Sustainable Development Goals. Philanthropy and government funding is not enough to meet this need and will require an additional $2.5 trillion a year to fill the gap.

Private capital has played an important role in social impact success stories: For example, the green revolution in agriculture and the development and delivery of life-saving vaccines all required private investment alongside philanthropy and government.

Now is a critical moment for the impact investing field: As more investors become interested in exploring impact investing, the risk of “impact washing” (a fund or company portraying itself as impact focused without actually having impact) becomes much higher. This is largely because there is still little agreement about what actually counts as an “impact investment.” Now is the time for new and existing impact investors to be thoughtful and intentional about defining what they mean by “impact.”

How do I know the results will align with impact investing standard-setting bodies?

Our work supports implementation of rigorous impact investing practices, informed by current industry knowledge, and aligned with a range of standard-setting bodies:

- We use the UN Sustainable Development Goals to align the impact of a client’s diverse portfolios to critical global priorities.

- All of our impact-measurement and -management frameworks are aligned to the Impact Management Project and the IFC Operating Principles for Impact Management.

- We are also well informed about other industry principles and tools (e.g., IRIS, GIIRS, SASB) and apply them based on client needs and context (e.g., using SASB to assess ESG materiality of client investments)

Industries Where We Have Worked