FAQs

FAQs What Is Impact Investing and Why Should You Care?The Global Impact Investing Network (GIIN) defines impact investing as investment into companies, organizations, and funds with the intention of generating social or environmental impact alongside a financial return. The exact impact will depend on the investor’s goals, while the financial returns can range from below-market to market rate.

Why do we care about impact investing?

Solving our biggest social problems requires private capital: The United Nations estimates a need for $3.9 trillion a year between now and 2030 to meet the Sustainable Development Goals. Philanthropy and government funding is not enough to meet this need and will require an additional $2.5 trillion a year to fill the gap.

Private capital has played an important role in social impact success stories: For example, the green revolution in agriculture and the development and delivery of life-saving vaccines all required private investment alongside philanthropy and government.

Now is a critical moment for the impact investing field: As more investors become interested in exploring impact investing, the risk of “impact washing” (a fund or company portraying itself as impact focused without actually having impact) becomes much higher. This is largely because there is still little agreement about what actually counts as an “impact investment.” Now is the time for new and existing impact investors to be thoughtful and intentional about defining what they mean by “impact.”

Different types of impact investing

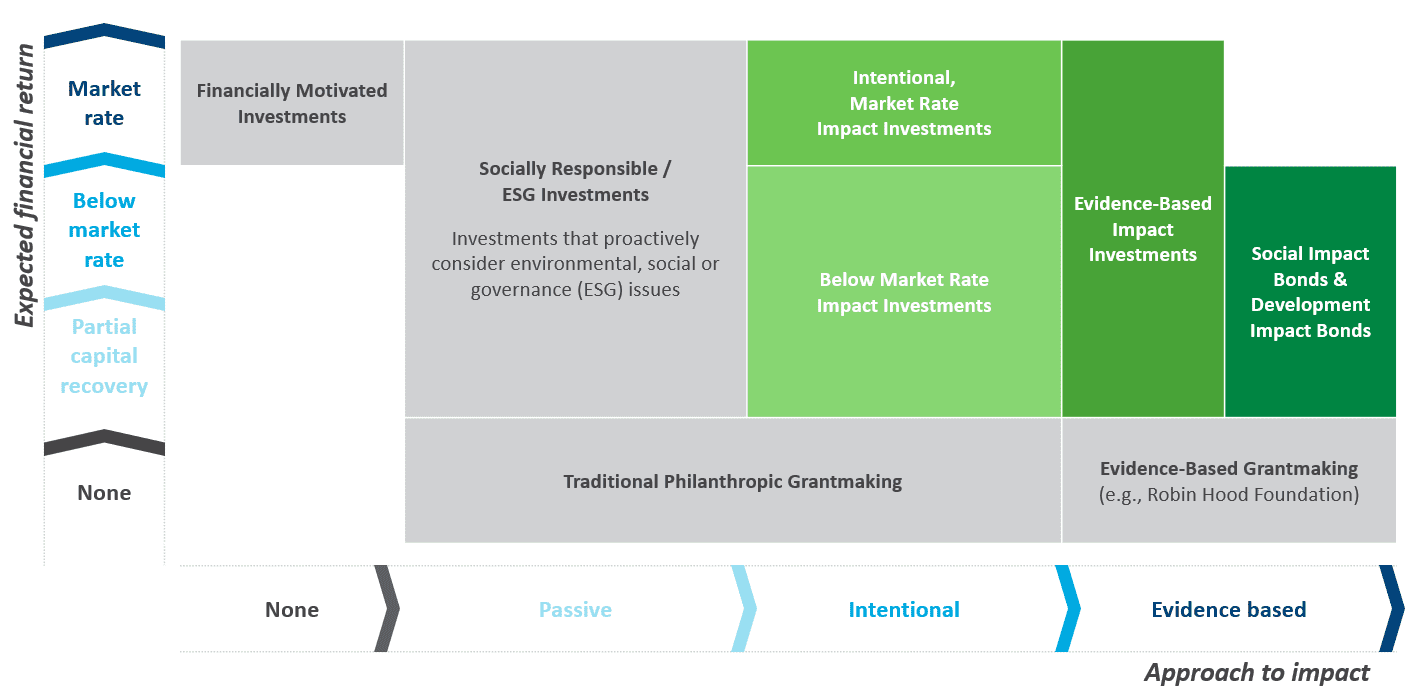

The chart below plots different investment types based on expected financial return and the approach to impact.

Impact investments can occur at different points on a spectrum of financial returns and approach to impact

Expected financial return: Investors and funders can have expectations ranging from complete loss of capital to market rate return (which varies widely, depending on context). This “returns continuum” includes everything from investments that result in market rate returns all the way to grants in which there is at least partial cost coverage. Impact investments do not have to be market-rate, also known as non-concessionary, to be an impact investment, but investors often expect some financial return. Some investors, however, may choose to accept a lower return as part of their strategy to unlock impact. This is in contrast to a pure grant or philanthropic gift, where investors don’t expect any financial gain.

Approach to impact: At its core, impact investing expects to create social impact. This impact exists on a spectrum from passive to evidence-based.

- Passive: Investors aim to produce social or environmental impact, but impact is not the primary aim of the investment. As a result, the investors do not hold themselves accountable for impact. Despite the lack of intent, some investors will still label investments in this category as “impact investments.”

- Intentional: Investors actively attempt to solve a social or environmental problem through the investment’s mode of production (e.g., creating a good or service generating fewer carbon emissions than other benchmarks) and/or directly through the product or service (e.g., opening a primary healthcare clinic in a rural community). In these cases, however, the investors generally do not base the investment on demonstrated evidence of impact; rather, they rely on instinct and intuition

- Evidence-based/field leader: Investors actively attempt to solve a social or environmental problem through the mode of production and/or through the product or service. The investor also bases investment decisions on demonstrated evidence of social or environmental impact (for example, on a published peer-reviewed study that demonstrates the effectiveness of a like product or service). Many of these investors also choose to share their practices more broadly through key venues (e.g., investor networks and conferences) and publications. It is important to note that there does not need to be a study done on the company’s specific product/service for an investment to be evidence-based. (Examples include Root Capital, The Rise Fund, and the Omidyar Network)

- None: Investors do not expect to create social impact with the investment. Even these investments may inadvertently produce positive social impact, but this does not count as an impact investment.

Who is engaged in impact investing?

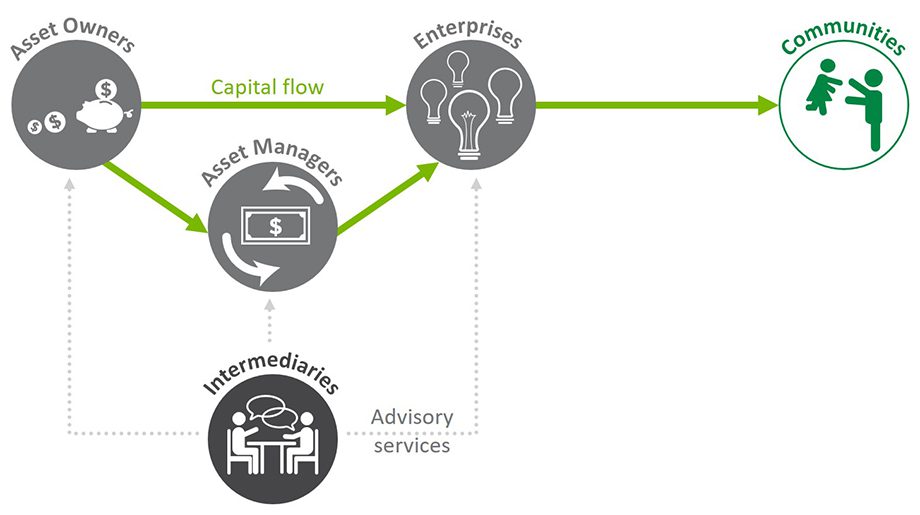

Many different stakeholder types are involved in impact investing. These include the following:

Asset owners and managers: Asset owners include foundations, individuals, pension funds, development finance institutions, and banks. They may do their own investing or hire asset managers to invest on their behalf. Asset managers (also known as fund managers) include private market funds, public market funds, debt lenders, funds of funds, and banks. These organizations often do the investing on behalf of the asset owners. Banks can be both owners and managers and can decide to invest their money in impact investments.

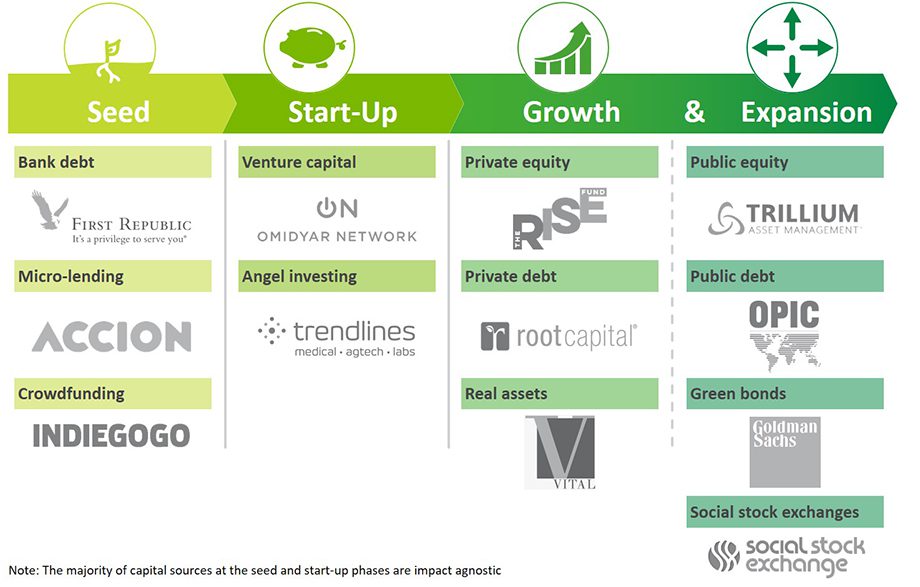

Impact investing is relevant for many asset classes, from seed funding to growth and expansion. This includes (but is not limited to): Bank debt, venture capital, private equity, private debt, real assets, fixed income, public equity, public debt, and green bonds.

Enterprises that receive impact investing funds

Many impact-focused enterprises structure themselves as for-profits. Other business structures can receive impact investments, however, including hybrids (e.g., nonprofit organizations with a for-profit subsidiary or vice versa), B-corps, and 501(c)(3)s (nonprofits). For example, nonprofits are often the recipients of social impact bonds.

Bridgespan believes enterprises with the following characteristics tend to be well-positioned for an impact investment:

Definable impact thesis connected to a big problem:

- Is mission-driven or possess a clear intention that impact can be logically tied to their company’s product/service (e.g., lock-step impact and profitability)

- Impact is connected to a benefit, a change for individuals, and/or populations to address a social challenge (e.g., United Nations Sustainable Development Goals)

- The proposed impact or solution must be feasible and actionable

Benefits society and/or high-need populations:

- Impact is either societal (e.g., environmental impact) or is aimed at a population in need (e.g., those at the bottom of the pyramid)

- Scale is large enough to make a meaningful impact on society and/or the populations in need

Aligns financial interests with impact interests:

- Investment-worthy companies must yield some financial returns. These can range from partial capital recovery to market-rate returns

Intermediaries: These organizations also play a critical role in the impact-investing field by creating networks, convening impact investors, providing consulting support and conducting research (e.g., the GIIN), the Impact Management Project, Bridgespan Social Impact, and Acumen’s Lean Data).

How do investors measure impact?

Impact assessment is difficult in the social sector in general, but it is especially hard in impact investing for a variety of reasons. For example, rigorous measurement is expensive, and therefore competes with financial returns. Many investments also target impact indirectly. And few “gold standard” measurement practices exist. (Though some—such as IMP’s five dimensions framework and Rise’s Impact Multiple of Money—are in active development.)

To circumvent these hurdles, many impact investors use a variety of common practices, including the following:

- Focus on outputs—the activities or products produced by the investment—instead of outcomes—the actual social or environmental impact created by the investment.

- Reliance on intuition and judgment rather than hard metrics.

- Point-in-time metrics—considering the impact at one time period versus over a full investment lifecycle.

Bridgespan Social Impact focuses on helping investors and the field shift to more rigorous impact-assessment methods—evidence-based impact investing. We help our clients adopt a variety of best practices, including the following:

- Moving from ex-post to ex-ante by incorporating impact assessment as a formal part of due diligence and estimating impact before an investor makes an investment.

- Embedding impact assessment across the deal lifecycle: considering impact from the beginning of due diligence and actively tracking and managing during holding and through exit.

- Measuring and estimating, where possible, outcomes, such as the meaningful change in people’s lives versus outputs such as activities, or the number of people served.

Investing in Human Rights: Six Areas for Impact and a Database of Change

By Capricorn Investment Group, Bridgespan Social Impact, Robert F. Kennedy Human Rights

When we think about human rights, we often picture activists with protest signs or diplomats at negotiation tables. But what about investors? The financial community has an increasingly powerful role to play in advancing human dignity around the world—and forward-thinking institutions are recognizing this opportunity.

Human Rights Investment Database

To help investors direct their capital and to explore how investors and funders are deploying capital toward human rights, we have curated a database of funds that are actively investing in human rights outcomes. This database documents each fund’s alignment with six key areas for human rights investment: health and quality of life, affordable housing, supply chain and fair labor practices, equal access to quality education, equal access to justice, and rights to opinion, information, and privacy.

Inside Impact Investing: Growth of Climate, Decline of Social, and More

In our inaugural video, Bridgespan partners Stephanie Kater and Michael Etzel discuss the rapid growth of climate-specific funds, the potential loss of momentum on social issues, and the future outlook of generalist funds.