Take it with you! Download this article as a PDF.

Impact investing has grown rapidly in the past few years— jumping from $502 billion in assets under management in 2019 to $715 billion in 2020. This reflects the rising desire among investors to direct more capital to businesses that have a positive impact on society and the environment.

Most impact investors are attracted to the impact that is inherent in companies’ products and services. Think of innovative edtech offerings, for example, or plant-based meat. Yet relatively few institutional impact investors have prioritized developing value-creation plans (VCPs) for impact.

How Impact Investors Create Value

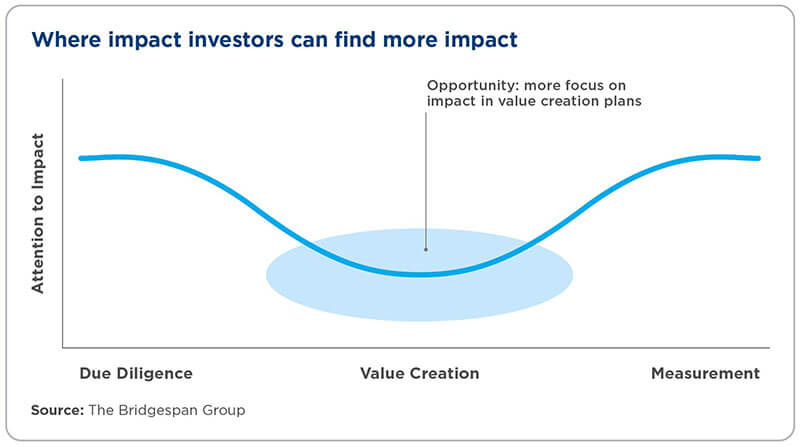

When the Impact Management Project launched five years ago, practitioners came together to put more emphasis on effective impact measurement and management practices. For institutional private-equity funds with impact products, the majority of focus and innovation since then has been on measurement—ensuring impact through due-diligence processes before an investment is made, and also into impact monitoring and reporting (and associated regulatory standardization and verification). While these are important, much less attention has been paid from an impact perspective to the management side of impact measurement and management.

This is all the more striking when you consider that effectively managing portfolio companies is the core role of asset managers. Private-equity funds are often active owners of businesses, able to roll up their sleeves and shape strategy and operations in ways that public market investors typically cannot. Upon making an investment, a fund will often develop and implement a VCP that sets out strategic priorities and focused initiatives for growing revenues, reducing costs, and maximizing shareholder value.

We believe there is a significant strategic opportunity for investors to emphasize the full impact potential for all stakeholders—that is, the ways in which businesses affect their employees, customers, suppliers, local communities, and the environment (alongside financial shareholders). With limited partners increasingly factoring impact into their investment allocation decisions, innovating on this dimension presents a compelling potential source of differentiation for general partners.

To be sure, a handful of institutional impact investors already put impact at the heart of their VCPs. From interviews we’ve conducted with a broad range of impact investors, as well as from our own observations from a decade of working in the field, we have synthesized three lessons for investors looking to manage their portfolio companies for impact.

Lesson 1: Embed Stakeholder Impact Considerations within a VCP

When developing a VCP, investors make important choices about a company’s broader strategy—both its “strategic ambition” and its decisions about “where to play” and “how to win.” At the heart of an effective strategy is identifying a company’s competitive advantage: Given its set of capabilities, what is its competitive “edge”? What is it uniquely positioned to do that others cannot? Where should it invest its (finite) resources to exploit its competitive advantage and make progress toward its strategic ambition? The VCP factors in all of these questions.

Impact fits squarely into this strategy process. There’s no such thing as a separate “impact VCP.” As Steve Ellis, co-managing partner of the RISE fund, emphasizes, “One thing that is very clear is that it is not possible to set a conventional strategy, then layer over an impact wrapper. Impact needs to be at the heart of the strategy-formulation process.”

For impact investors, this means, first of all, setting a strategic ambition that speaks to the role a business plays in society beyond delivering financial returns for its investors. The strategic choices that follow are based on a robust evidence base that includes both conventional commercial data and insights about the likely social and environmental outcomes of these choices for all of a company’s stakeholders.

Practically speaking, embedding stakeholder considerations throughout a portfolio company’s VCP typically requires an integrated approach to impact and environmental, social, and governance (ESG) topics during strategy formulation, with tools such as the B-Impact assessment or Ecovadis’s sustainability assessment providing helpful analysis and benchmarking of a company’s holistic footprint. Bain Capital Double Impact is one example of a fund that has used the B-Impact assessment (supplemented by bespoke impact insights on product and service outcomes for each investment) as a baseline to help identify opportunities for all of its portfolio companies to improve outcomes across stakeholders.

Lesson 2: Learning from Impact Due Diligence Is Vital for Informing a Company’s Strategy

In setting the future strategic direction of a company, impact investors should draw on insights generated during the impact due-diligence process (or from a buildout of an impact evidence base) to ensure that the strategy truly maximizes long-term social and environmental outcomes.

Importantly, impact due diligence often yields critical insights that can help strengthen business models. Raghu Kolli, Head of Customer Centricity at LeapFrog Investments, agrees. “At LeapFrog, our strategy is all about investing in companies delivering essential services to consumers living on less than 10 dollars a day in emerging markets,” Kolli says. “When serving these customers, you have to start with a deep understanding of their needs. Products and services need to be tested before launch for relevance, affordability, and quality of experience. Only then can you deliver solutions that can truly help improve their lives. We assess companies for their customer experience and innovation capabilities.”

At the same time, due diligence is just the beginning of learning about the impact potential of a business. Another fund highlighted this dynamic in its investment in an education software provider. During due diligence, all eyes were on student usage metrics that would ensure students reached critical thresholds. Over two years of ownership, after exploring a range of opportunities to increase both learning attainment and revenue, the investor found teacher engagement to be the missing link. This insight has led to investing in functionality that helps teachers understand exactly how well students are progressing and which students need additional, targeted support. In this instance, starting out with impact at the heart of the VCP generated powerful insights that have helped the company to outperform in both financial and impact terms.

Lesson 3: New Impact-Related Playbooks Can Drive Impact across a Portfolio

Private-equity funds that engage in a hands-on fashion with their portfolio companies often develop playbooks: standardized templates on how to execute repeatable best practices on topics ranging from supply-chain optimization to pricing excellence. We believe there is likely to be significant benefit for impact investors from developing targeted playbooks (see “The Many Potential Uses of Impact Playbooks”) that address recurrent impact and ESG topics.

For example, consider the potential for an “impact incentives” playbook covering how an investor can effectively shift management incentives away from short-term financial metrics toward long-term impact metrics and stakeholder value creation (while empowering managers to make the necessary decisions without fear of negative personal consequences). If, by contrast, management teams are rewarded predominantly for hitting short-term revenue or profitability targets (as so often happens today), it should be no surprise that—however well-intentioned these teams might be—they will prioritize these short-term financial goals over long-term impact ones.

Cecilia Chao, managing director at Bain Capital Double Impact, says that creating the right incentives is at the core of how the fund engages with its portfolio companies: “We look to partner with our management teams to develop an impact blueprint with a clear set of initiatives that will achieve results, and then ensure that those teams have aligned bonus incentives to motivate them to deliver those results.”

Importantly, successful performance against impact metrics is both a sign that a company is effectively addressing societal problems and a leading indicator of future financial performance. Indeed, having clarity on the impact metrics that really matter, and effectively aligning and incentivizing management around them, often leads to a stronger, more focused strategy that enables a self-reinforcing cycle of growth, impact, and financial performance.

The Many Potential Uses of Impact PlaybooksIn addition to the creation of the right incentives for management in portfolio companies, topics for which we would recommend that impact funds develop playbooks include:

|

Investors typically spend six weeks conducting due diligence on a potential acquisition, then six years managing that business to maximize value. What might the world look like if, instead of relegating impact considerations to due diligence, monitoring, and reporting, more investors put impact at the heart of the time- and labor-intensive work of value creation? That’s how we think they can bring vastly more impact to their portfolios.

Michael Etzel is a partner and Jancy Langley is a manager at the Bridgespan Group, based in Boston. Ben Morley is a director in Bain & Company’s social impact practice.