More than $13 trillion in investment capital is now aligned with human rights initiatives, representing the work of roughly 115 institutional investors collaborating through Principles of Responsible Investment (PRI). This elevates the issue beyond a feel-good activity; it has become central to responsible investment strategies that recognize the connection between preserving basic human dignity and creating sustainable returns.

The momentum behind this movement is building through a combination of new regulations, heightened public awareness, and growing evidence that businesses protecting fundamental freedoms—like the right to life and liberty, freedom from discrimination, and fair working conditions—drive both social and financial value.

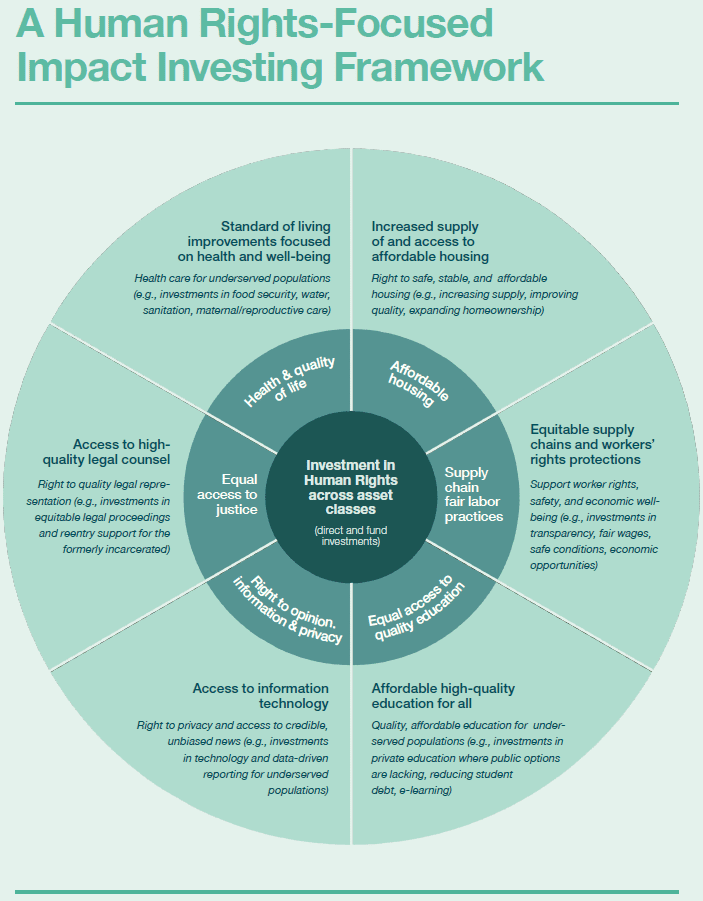

For institutional investors looking to make an impact, human rights investments offer a spectrum of opportunities across different risk profiles, time horizons, and return expectations. Whether through market-rate returns, concessionary capital, or strategic grants, there are several pathways to incorporate human rights considerations into investment portfolios while still meeting financial objectives.

This report explores how institutional investors can strategically direct capital towards ventures, initiatives, and funds that prioritize human rights, contributing to a more equitable world while building portfolios aligned with both values and investment goals.

For a detailed exploration, please download the full report. You can also view our non-comprehensive database of funds that are putting capital to work for human rights.